Why holding too much cash is a bad thing

Everyone likes cash. It gives us a feeling of security. When it’s sitting in your bank account, you feel much more relaxed. Life can now throw its occasional obstacles in front of your feet.

Even though paying digitally has become popular, it’s still a different sensation having those old-school banknotes in your pocket and paying with them. But we have to talk about a dirty secret of cash: It’s eating holes in your pocket and robbing you of opportunities! 💸

Inflation eats away your cash

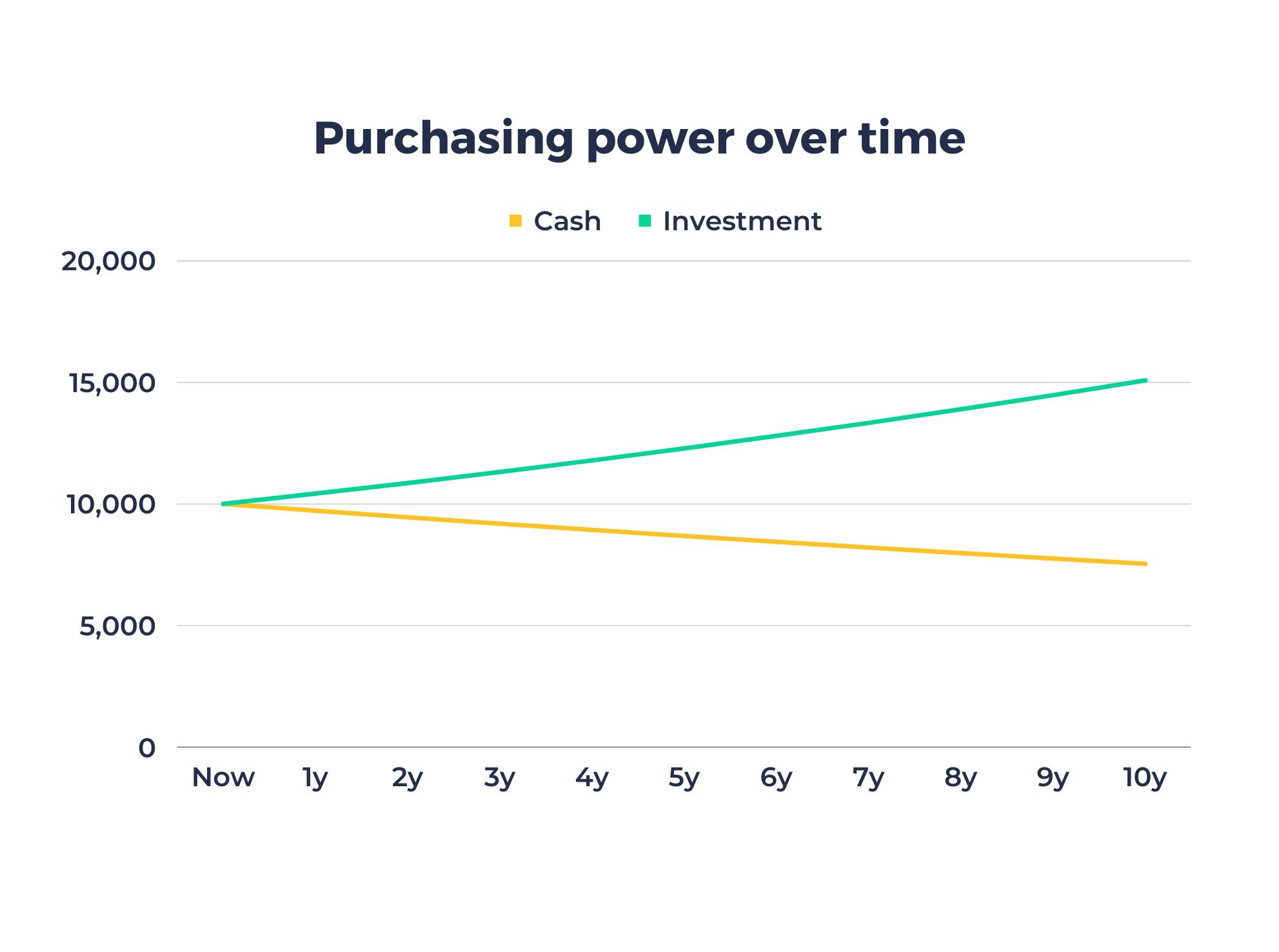

Inflation affects cash in all forms – regardless if you have it on your account (i.e. “digital cash”), or actual cash in your pocket. The current inflation rate in Switzerland is 2.8 %. Roughly speaking, this means that each year you can buy almost 3% less stuff with the same amount of money. So, one bite of your favorite chocolate bar is gone. 😢

At first glance, this might look like a small problem. But inflation works like compound interest, just this time against you!

Here is an example:

Cash now: 10'000 CHF

After 4 years with an average 2.8% inflation:

In today’s buying power, just 8’926 CHF is left

Lost buying power: 1’074 CHF

Prevention is better than cure

Regaining what you have lost from inflation becomes ever harder, the longer you wait. The problem is that a 10% investment return on those 8’926 CHF is less than a 10% return on the original 10’000 CHF (893 vs. 1’000 CHF). So, the earlier you start investing your money, the better are your chances of beating inflation.

To consider

Keep in mind the bank fees. Banks charge you various direct fees to keep your account up and running. With a few bucks a month that’s often around 60-120 CHF in fees per year.

Missed opportunities cost

Here comes the biggest story: Think about what you could have done with that cash.

Missed joy

Maybe saving that amount of cash meant giving up that trip to Bali, or not buying a new laptop. Saving money for other opportunities isn’t necessarily a bad thing to do, but keep in mind, over time fees and inflation will reduce your buying power.

Missed returns

Missed returns are the benefits of investing that one might have experienced, had they "put the money to work". What it means in practice depends on how much risk one can and should take.

A popular excuse for keeping cash in one's account (or under the mattress) is that at least one can be sure 10’000 CHF will still be 10’000 CHF in four years. We’ve already seen that this is not really the truth due to inflation.

Time is against cash

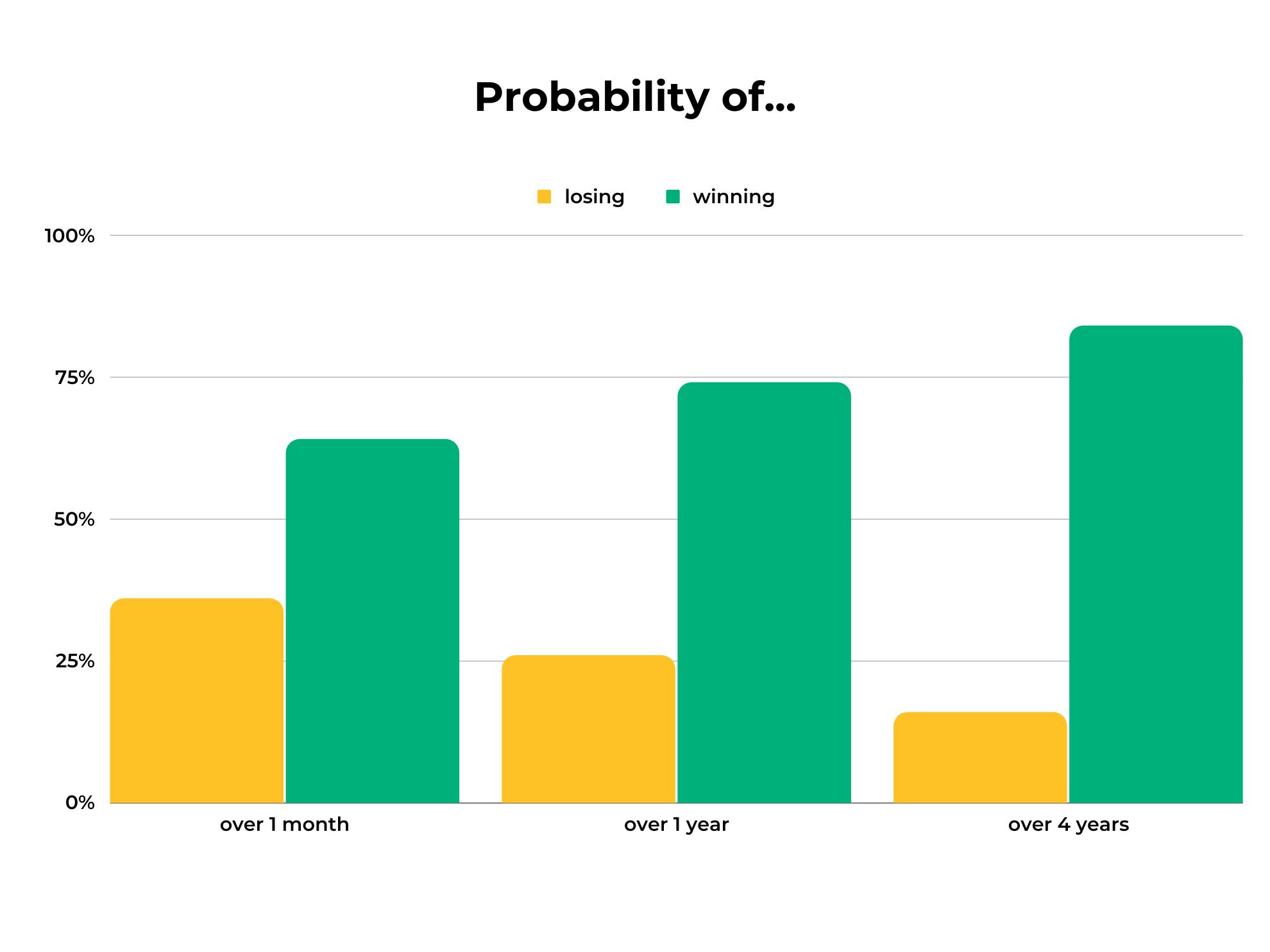

We dug deep into financial history, summing up data from the last 100 years, to give you really robust estimates:

Over one month, the chances of beating a cash account with investing are indeed not so clear. But it’s already much better than a coin toss.

Over one year, however, a cash account has only a 1-in-4 chance of beating the investment. And over four years, chances are down to 1-in-6!

Now you may rightly think “what if I’m that unlucky sixth guy?”

Then you just have to wait a bit for markets to recover. Historically, it took just 1 year for this investment example to recover. In the worst case (World War 2, 1940s), it took 4 years.

As a result of inflation and the potential of solid investment returns, cash looks pretty bad in comparison to investing, the longer you wait.

Good reasons to hold cash

This article should by no means convince you that cash is bad in general.

It is always good to have a cash buffer set aside. This should prepare you for the very unlikely, but more risky situations in life:

- Being temporarily unemployed and having to draw on your savings to uphold your living standard

- Major medical expenses

- Unforeseen life-changing events, that may have you relocate, or pay for something expensive

A good rule of thumb is for the cash buffer to equal around three times your total monthly expenses.

Maybe you also plan to buy a new huge TV in Ultra HD, or you’d like to renovate your apartment in the near future? Then also set aside some cash for such planned expenses. Before you set aside too much cash, don’t forget that your regular savings over the coming months may already (partially) cover the upcoming expenses!

Invest only what you can commit for a longer period of time, ideally 10 years and longer. But, please, whatever you do, don’t sit on too much cash for 10 years. 😉

Daniel Trum

Daniel is an economist (MSc) and financial analyst with over 10 years experience in the Swiss banking industry. He leads the investment management at Selma and he’s passionate about finding better ways to invest for everybody. Follow him on LinkedIn to get regular updates on what he thinks about financial markets.

LinkedIn