Why do I need a tailored investment solution?

Everybody deserves a tailored solution for one's investments – even so without getting one's hands dirty. A standard robo-advisor probably asks you how much risk you like, lets you choose between a handful of ready-made strategies, and then lets your portfolio run like this forever. Most likely this is not what you have in mind.

Everybody’s life situation differs and is complex in its own way. That’s why investing should start with an “holistic” point of view. What does this mean? Holistic means to “deal with or treat the whole of something or someone and not just a part of it.”*

*Definition by Cambridge dictionary: https://dictionary.cambridge.org/dictionary/english/holistic

Let’s clarify this with an example. Anna (39) and Martin (42) are a couple and would like to start investing. Both have a stable job and have a medium risk willingness.

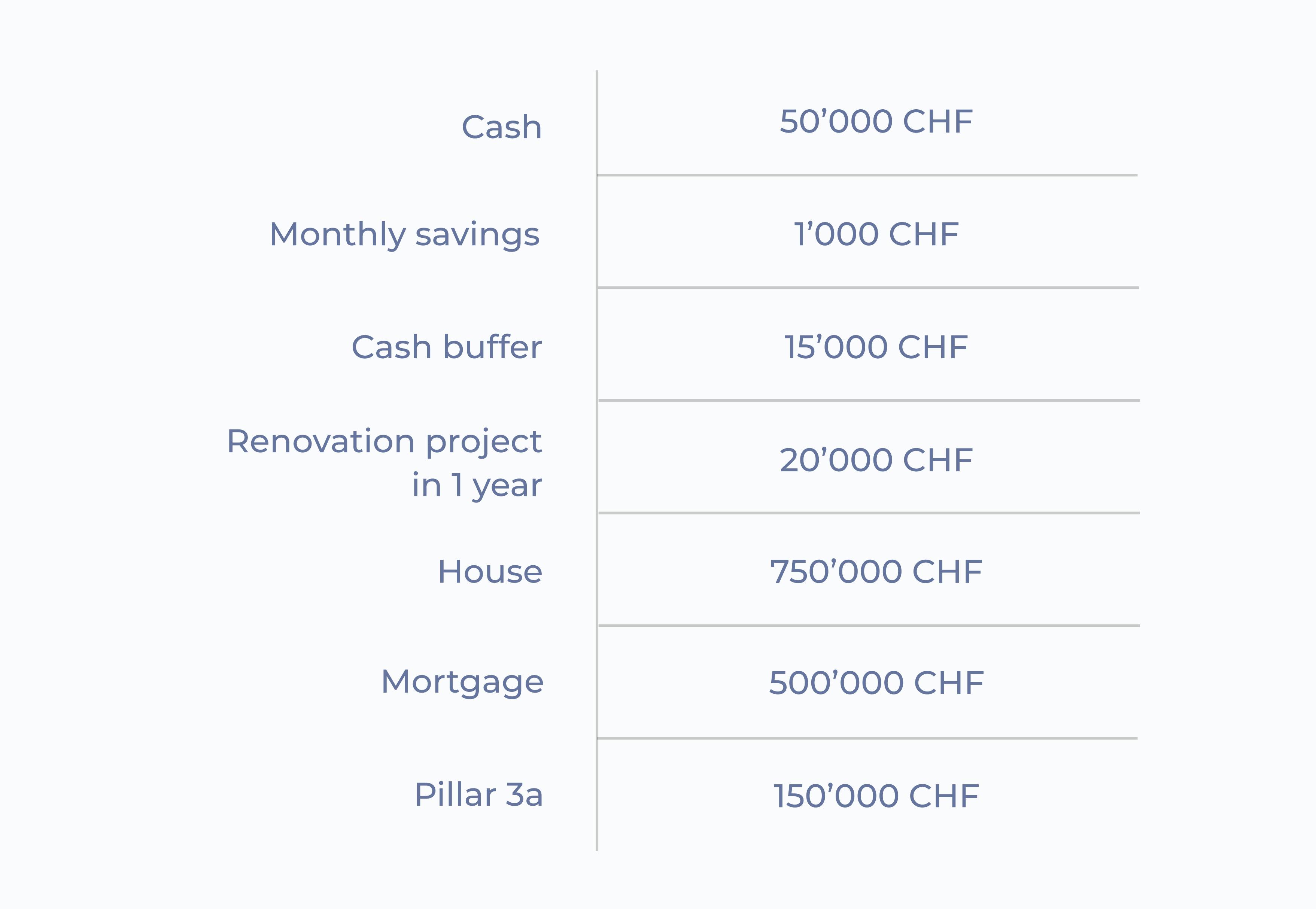

Here’s their current situation.

Investment advice differs depending on how many of the things listed above one takes into consideration. Let’s start with the obvious things.

The risk relationship

A successful investment strategy requires a good match between the risk level of the strategy, the risk ability and willingness of the investor. Only with a good fit of these factors will people stick to their plan and strategy, even when times are tougher.

The example couple says that they are rather cautious (medium risk willingness), so their portfolio should probably not have more than around 50% in company shares and other growth-oriented investments. Their age, stable jobs, and the amount of monthly savings could tell you that such a “half-growth, half-stable” portfolio could be ideal. After removing their desired cash buffer, 35’000 CHF would be left for investing immediately. 💸

Consider upcoming spending plans

Let’s pretend there is a 20’000 CHF renovation project coming up – things already look a bit different. The monthly savings are not enough to finance the upcoming expenses. In order to avoid selling some investments at an unfavorable time, it would be better to not invest everything immediately. Who knows, maybe the once-a-decade market crash happens within the first 12 months! If then some money is needed to finance a renovation project, Anna and Martin cannot give their investments a chance to balance out its losses.

One solution could be to leave 8’000 CHF in cash from the 35’000 CHF investable amount. The other 12’000 CHF to finance the renovation project can come from their savings over the next 12 months.

Tailoring the scope of investments

It’s also important to have a look at what products are put into your investment portfolio. Let’s consider our couple's home ownership. If there is already a home ownership, investing into further real estate is not the best way to go. This would make one only more dependent on a single piece of the global investable market: real estate. Therefore, Selma would exclude the ETF for real estate in this example.

Making it REALLY HOLISTIC

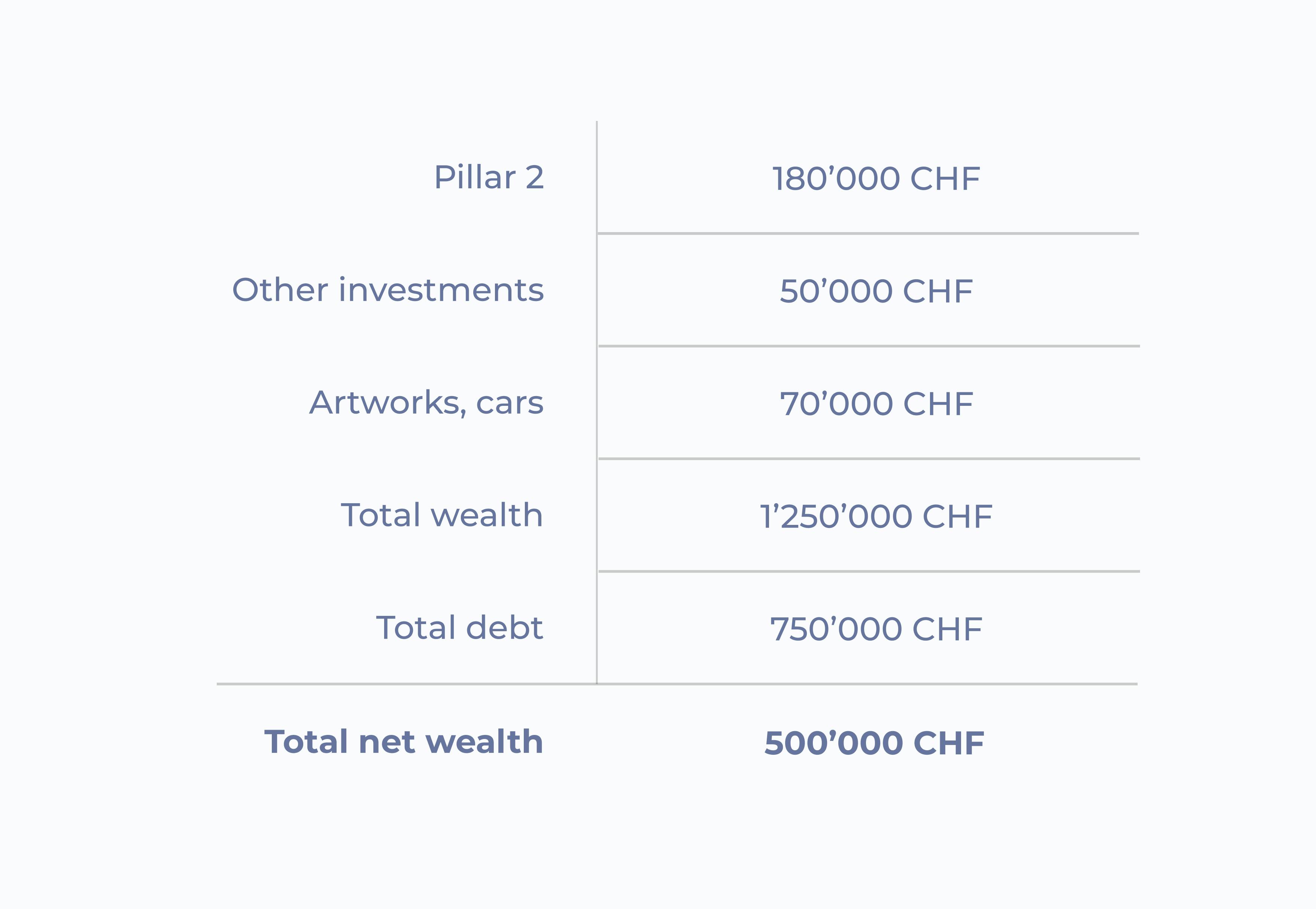

Now to the real “holistic” stuff: Retirement savings and other investments. Anna and Martin have significant wealth in pillar 2 and pillar 3a and fund “from the bank”. These are effective investments in financial markets but need their own strategy. Let’s assume these investments are rather defensively invested, for instance 30% in company shares and 70% in loans.

In this situation, it would be a good recommendation to have a portfolio that overcompensates the lack of growth investments so far. Otherwise, this nice couple will not receive enough returns for their retirement and they would have invested at too low risk levels.

In other words, all the information snippets we collected from this couple are intimately interconnected, and thus the question “what is the right investment for them?” can only be answered by looking at their whole wealth situation. This is the holistic wealth perspective.

Everything flows

The Greek philosopher Heraclitus probably didn’t worry about his mix of investments (there were no financial markets!). But his hallmark saying “everything flows” describes pretty well the next (and final) layer of complexity in our example: Our couple will inevitably get older.

Firstly, getting older normally requires a gradually less risky investment mix. As retirement comes closer, it is better to reduce risks, so that your portfolio is not experiencing a bad phase just when you want to start withdrawing money for your retirement.

Secondly, major changes will happen in the mix of assets and liabilities of this couple. Probably their savings in pillar 2 and 3a, their wealth in form of cars and art works, will grow larger until retirement. Additionally, they will likely have less debt as they pay off their mortgage. As a result, they may actually afford a slightly riskier investment mix than otherwise.

Selma calculates it for you

As you can see in this fictional example, it would be very difficult and time consuming to do all the math on your own. This is where the Selma algorithm can help you to get a holistic overview of your wealth and to determine the right investment mix that fits your situation. All you have to do is answer a few questions. From there on the algorithm takes care of the rest.

Most importantly, you can easily keep the algorithm up-to-date about changes in your life situation. It will then re-calculate quickly and determine the new investment mix that suits you. 👍

Daniel Trum

Daniel is an economist (MSc) and financial analyst with over 10 years experience in the Swiss banking industry. He leads the investment management at Selma and he’s passionate about finding better ways to invest for everybody. Follow him on LinkedIn to get regular updates on what he thinks about financial markets.

LinkedIn