How risky is investing?

Selma – your friendly bot 🤖 who has statistics for breakfast – wants to put your fear of investment risks into context.

Good to know

- The biggest risks come from choosing the wrong strategy for yourself, not properly spreading your investments (aka lack of “diversification”), and unfortunate timing.

- Especially picking the wrong entry point is a big worry for many. Therefor we recommend to invest regularly. This way you can buy investments over time and split your split your risk.

- For all mentioned risks the Selma bot has you covered: From a tailored strategy, over diversification to managing the timing of investments.

Every coin has two sides – defining risk

The word “risk” usually has only a negative connotation. But like the saying goes, “no risk, no fun”. In investing, you could say “no risk, no return”. Risk is the other side of the coin where return is written on. So, what is this risk, anyway?

If you’ve come here to read this, you are probably not going to day-trade anyway, so we can skip the biggest risk, speculating away your money with super-risky horse-racing-style bets. 🏇 Using more regular examples of investing, you will see in this article where the main sources of risk are, what their impact is, and how you can deal with them.

In order to manage the risk you are taking well, there are three key areas you can work with: the correct strategy, diversification, and time.

Feel comfortable with your strategy

This may sound a bit confusing, but it’s indeed very important to pick the right level of risk for yourself. If you pick a too careful strategy, you may be disappointed by the lower returns after a few years. Nobody can give you back those years. If your strategy is too wild to stomach 🤢, you may very well jump off the train at a bad moment and lock in your losses.

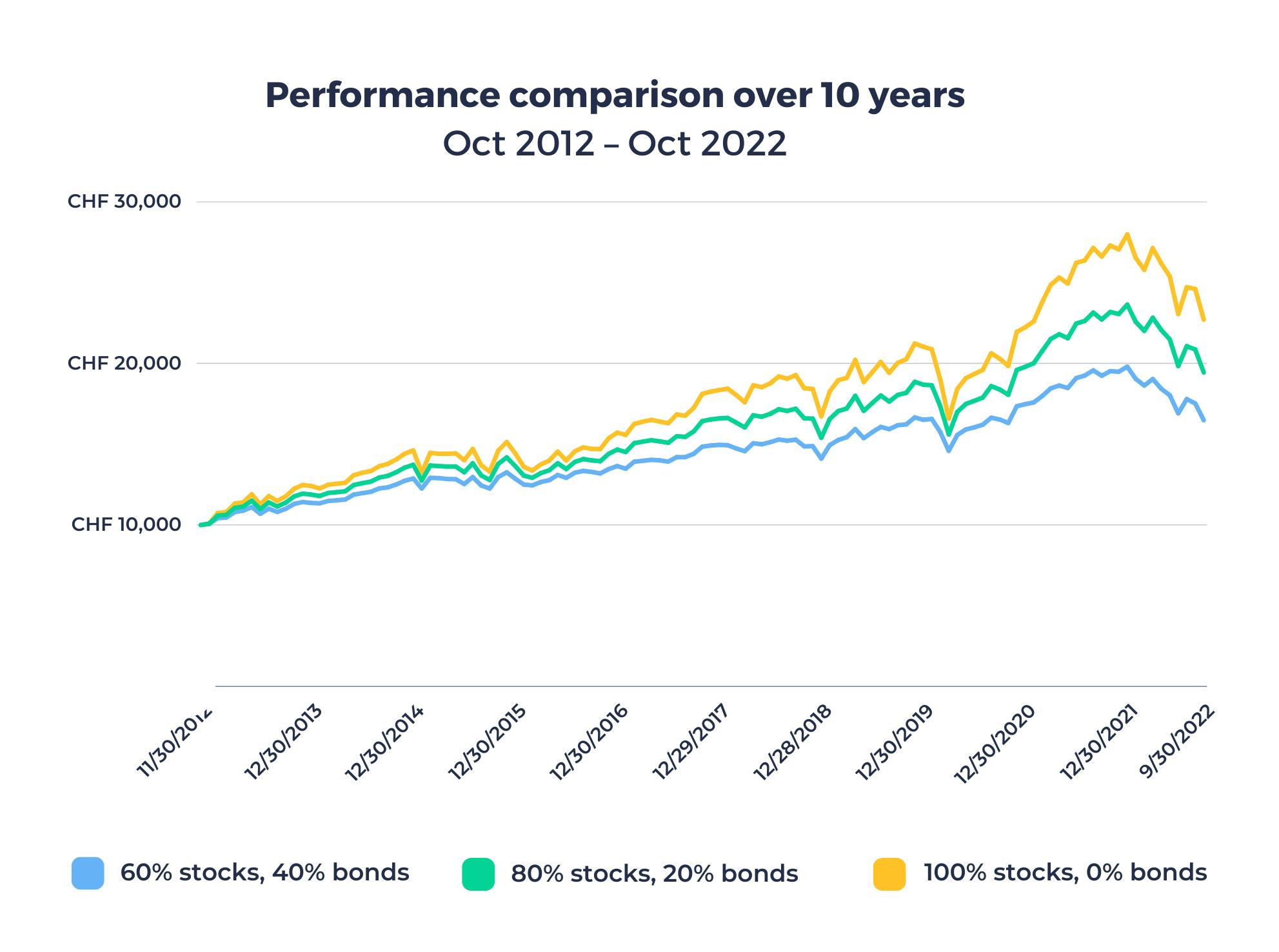

For illustration purposes, consider how different the strategies shown below are, when it comes to return and risk. It should be very clear that the aforementioned “mistakes” can cost you double-digit returns:

Note: These model portfolios consist of two ETFs, the BlackRock iShares Core MSCI World UCITS ETF USD (Acc) for stocks, and the Xtrackers II Global Government Bond UCITS ETF 4C – CHF hedged for bonds. The returns are before fees and trading costs.

Disclaimer: Past performance is no indication of future performance!

Selma’s algorithm takes a look at your life situation and creates a tailored strategy that should suit you long-term!

Diversification doesn’t come so easily!

The examples shown before are already relatively well-diversified portfolios. Investing in narrower baskets or even single stocks, your outcomes may vary even more wildly. Just consider this example, how global diversification can help you avoid pitfalls:

Between 2015 and 2021 the index for UK company shares suffered heavily from Brexit. The German and French stock markets gained over 50% more than the UK index, when you include the weakening of the British pound sterling! 😱

However, in the first 10 months of 2022 fortunes changed. The British index won over 10% against the German one, as the energy crisis in Europe favored the big energy companies (think Shell, BP) of the British index over the German manufacturing companies.

Did you know?

Selma’s approach is to reduce risk by spreading your investments with a global selection of broad ETFs (What’s an ETF you ask?). Regular adjustments of your investments based on long-term measurements of over- and undervaluations should further reduce your risks.

When is the right time to invest?

Probably the biggest fear every investor has is to enter the market at the wrong time (yes, you are not alone with that fear 🤗). Statistics will tell you that, if you invest your cash 100 times, putting it to work all at once will trump a more careful stepwise approach. The only problem with this is, that many of you will only do that once or twice in their life. Statistics will be little consolation if that one time has gone wrong.

At Selma we recommend you to invest regularly. This way you distribute you can reduce the risk.

Conclusion

Now you have gotten a glimpse on how important the three major risks in investing are: picking the right strategy, being diversified, and managing your entry into the market.

These things may sound much less exciting than picking between single company shares, but they are proven to work and they can make a huge difference for your investment outcomes. Neglecting them can mean taking on very large risks. But using them to your advantage can reduce risk a lot, while still generating appropriate returns.

Daniel Trum

Daniel is an economist (MSc) and financial analyst with over 10 years experience in the Swiss banking industry. He leads the investment management at Selma and he’s passionate about finding better ways to invest for everybody. Follow him on LinkedIn to get regular updates on what he thinks about financial markets.

LinkedIn