Investing your retirement savings - A guide

Retirement should be your time for enjoyment – without stress and without worrying about your finances and how long you will be able to get by on your capital.

Preparing for retirement raises important questions: What’s the best strategy? How should you invest your money? How can you draw your funds in a way that ensures they last a lifetime? And that’s where Selma can guide you. Here are some of our best insights on what to consider when investing your retirement savings.

Why pensioners prefer a lump-sum over a pension

A (partial) lump-sum payment from the second pillar can offer pensioners decisive advantages. Let’s have a look at the most important reasons why pensioners opt for a lump-sum payment.

Advantages of a Lump-Sum withdrawal (compared to a pension)

- Increased financial flexibility

You can plan your personal cash flows individually and adjust them to your needs. - Lower income taxes

A lump-sum payment often offers tax advantages over a monthly pension, as the withdrawal of pension capital is taxed separately. - Opportunity for higher returns

With an investment strategy tailored to your needs, you can achieve a higher return than with a pension conversion, depending on the conversion rate. - Protection for your partner and heirs

The asset becomes your property and can be passed on to your heirs. You also have the option of granting an inheritance advance to your descendants. - Pay off mortgages

You can use the capital to repay existing mortgages in part or in full, thus reducing your monthly fixed costs. - Control over investment decisions

You remain in control of how you invest your capital and can customise the risk strategy to suit your overall financial situation.

The advantages of a pension

A monthly pension offers clear advantages, especially if you are on a tight budget and don't have much in the way of savings:

- Predictability: regular payments make financial planning easier.

- Stability: instead of a salary, the pension provides a regular income.

- No administrative tasks: the pension fund takes care of your assets, so you don't have to worry about investment decisions.

- Higher payout: pension funds often offer better conversion rates than private life annuities.

- Protection against inflation: some pension funds adjust pensions for inflation (be sure to check!).

- Survivors' pensions: surviving partners or children continue to receive financial support in the event of death.

This makes the monthly pension an easy and secure solution for many pensioners, especially if you don't have a lot of savings.

Selma offers independent financial planning in collaboration with partners to analyse your personal situation.

Lump-Sum withdrawal: What next?

Nowadays, more than 57% of Swiss residents choose to withdraw at least part of their retirement savings as a lump sum. For many, this means a one-time withdrawal of several hundred thousand francs—or even into the millions.

For most people, it’s the first time they’ve had to manage such a large amount of money — a situation that can cause additional stress. But don’t worry, we’ll help you make the right decision.

Leave your assets in the bank account? Not a great idea

If you simply park the assets you have withdrawn in your bank account and live on the interest, you probably would have been better off with the monthly pension. With a lump-sum withdrawal, you take responsibility for investing and managing your money in such a way that your income is secured in the long term.

The risks: capital used up faster than expected

Unfortunately, pensioners often use up the capital they have received after just 5 to 10 years. From this point on, often the only source of income left is the AHV (and a possible partial pension fund pension) – which means a significant reduction in living standards.

This is usually not due to an extravagant lifestyle, but rather a lack of understanding of how to invest capital in a way that ensures a secure income in the long term.

How to protect your capital in the long term

To make sure this doesn't happen to you, we've put together a guide to help you manage your capital, from choosing the right investment strategy to planning your withdrawals.

The investment plan for your retirement

To ensure that your assets last for the rest of your life, they have to continue to generate returns. Otherwise, there is a risk that they will not last until you reach a ripe old age.

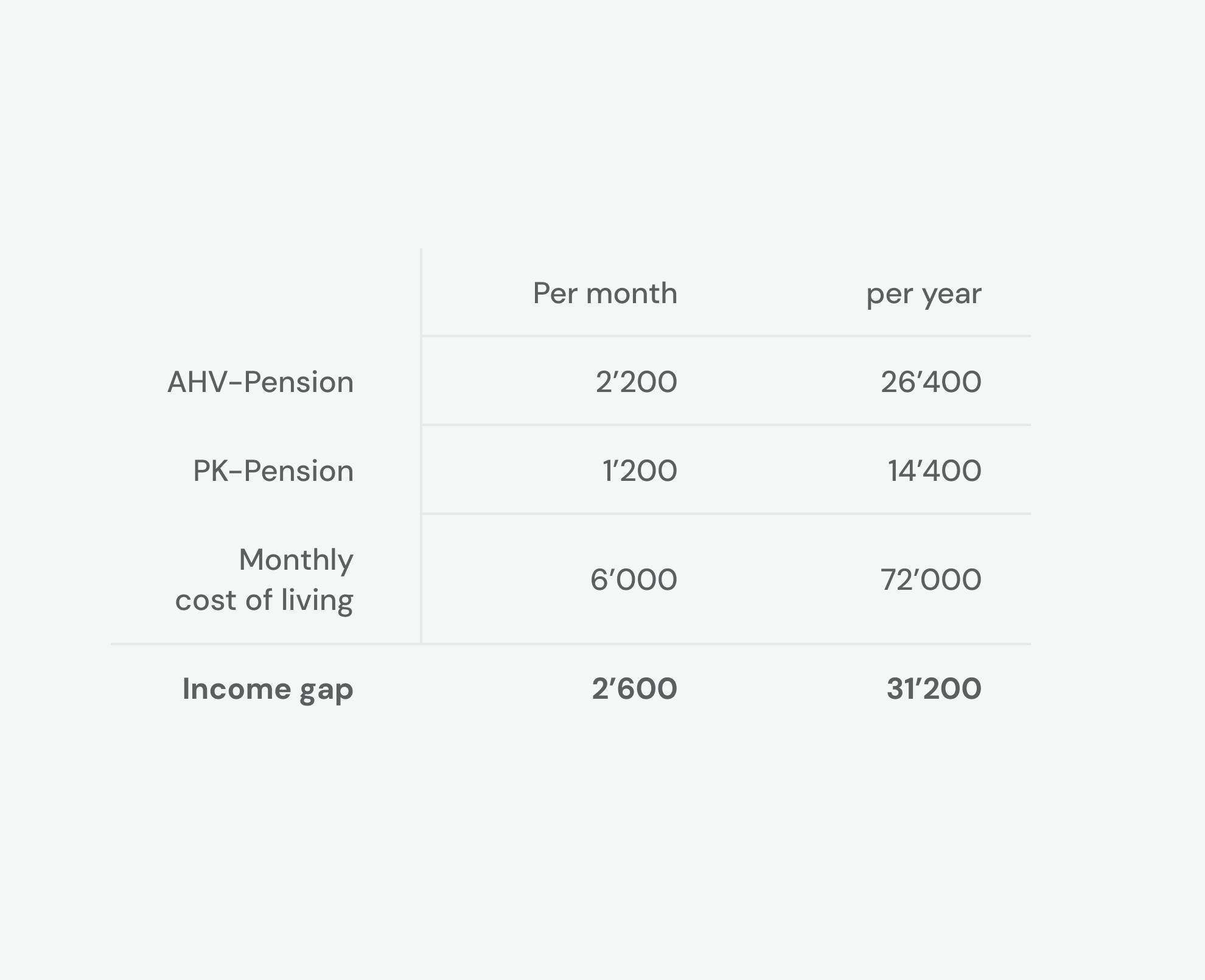

When you retire, your income often no longer fully covers your monthly expenses. This difference is called an ‘income gap’. That's why you need a larger cash buffer in your retirement that should not be invested. This buffer should be sufficient to cover your income gap for the next 2 to 3 years.

An example for your cash-buffer:

Example: Calculating your cash reserve

- Monthly Income Gap: CHF 2’600

- Cash Reserve for 3 Years: CHF 2’600 x 12 months x 3 years = CHF 93’600

👉 Keep CHF 93’600 in cash to secure your living expenses for the next 3 years.

Any wealth beyond this reserve should be invested so it continues to work for you and generate returns.

The goal: Grow your reserves over the long term and maintain financial stability.

How to invest money in retirement – the strategy

When you retire, you can no longer take the same risks as someone at the beginning of their professional career. That's why it's all the more important to tailor your investment strategy to your financial situation, to spread risks and to keep costs as low as possible.

1. Diversification of investments: diversification is crucial

Pension funds manage billions of francs to invest securely, focusing on the long term, and ensuring they can meet financial obligations, such as pension payments, consistently over time.

They do not invest speculatively, but rather in a broadly diversified manner. Their investment strategies typically include income-generating investments such as:

- Shares

- Bonds

- Real estate

This approach by pension funds also makes sense for you to reduce your risk in retirement and to diversify your assets. Your portfolio should therefore also be broadly diversified, for example, with:

- shares for growth,

- bonds for stability,

- real estate as tangible assets and protection against inflation,

- precious metals as a hedge against crises.

The so-called global market portfolio, which reflects the global financial market, offers a good starting point.

2. Liquidity of investments: maintaining flexibility

In retirement, it is crucial to pay attention to the liquidity of your investments so that you can access your assets quickly when needed.

Exchange-traded funds (ETFs) are an ideal solution. These offer:

- A cost-effective way to diversify broadly across thousands of companies.

- The flexibility to be traded on the stock exchange at any time. This means that ETFs can be bought and sold quickly and easily.

With a well-diversified and liquid portfolio, you can manage your assets sensibly in retirement while ensuring financial security.

3. Global diversification vs. a focus on Switzerland: When does Switzerland focus make sense?

As a general rule, it is crucial to spread your investments as widely as possible so as not to be overly dependent on individual economies. Global diversification reduces risk and ensures that your portfolio remains stable even if a single market weakens.

When does it make sense to focus on Switzerland?

A stronger focus on Swiss investments can make sense in certain situations, for example:

- If your livelihood is heavily dependent on the Swiss franc and you want to minimise currency risks.

- If you want to keep more of your investments in a stable and familiar market.

- If you want to support Swiss companies and their economic development specifically.

💡 Since pension funds usually invest a large part of their assets in Switzerland, it makes sense to increase the share of Swiss investments in your private portfolio when you make a lump-sum withdrawal so that your currency and country risk does not increase.

Tip

With Selma, you can easily adjust your investment preferences and, for example, activate a Swiss focus or sustainable investments with just one click.

When to use capital and how to live off your portfolio?

The aim is to make your invested capital work for you and generate returns for as long as possible. At the same time, you use your savings to close your pension gap. At some point, you will therefore need to access some of your investments. But when and how best to do so?

Our recommendation:

- Cash buffer: Always keep a cash reserve that covers your pension gap for two to three years.

- Invest the rest of your assets: Keep the remaining capital invested so that it generates a return. Use investment income and dividends for consumption so that you don't have to touch your portfolio later.

- Sell as needed: Once the cash buffer is depleted, sell some of your investments to replenish the buffer for 2-3 years.

This approach helps you to get the most out of your assets over the long term while ensuring financial security.

Do you need help creating your investment plan and withdrawal plan? Just get in touch and we'll work with you on it.

Benefits of Selma as a pensioner

- Your tailored investment strategy

Selma creates an investment strategy that is specifically tailored to your individual situation as a retiree.

- Cost-efficient ETF portfolios

Benefit from ETF portfolios with maximum diversification across different asset classes and markets – for more security and long-term stability.

- Fully automated management

Your investments are managed by Selma Finance AG, a regulated asset manager in Switzerland. This way, your portfolio stays on track while you enjoy your retirement to the fullest.

- 100% liquid investments

You can withdraw capital whenever you need it. Payouts are made within a few days – quickly and reliably.

- Independent management and Swiss bank account

Your investments are always held in your name in a Swiss bank account and managed by the regulated Selma Finance AG for maximum security.

- Anytime Free and flexible withdrawals

You can withdraw your money anytime for free and without restrictions. Sales are processed instantly and paid out in a few days.

- Free support from financial experts and Selma AI

- Get support from our financial experts or use Selma AI to answer your questions about investing.

Kevin Linser

Kevin is a co-founder of Selma Finance. He helps you to get started with Selma and keeps you up to date. Outside the office you can spot him🎿 or 🏃.

LinkedIn