Market update: 2020, what a year!

2020 will forever be remembered as the year the COVID19 crisis started - which in itself is a very good reason to turn the pages and try to forget 2020 as fast as possible, but behold – read this blog post to find out what you can learn from it.

The world has definitely learned a lot about dealing with pandemics in 2020. And when it comes to investing, 2020 has offered important learnings that are good to keep in mind when investing money long-term.

It has shown the world a crisis with even steeper, faster drops than the financial crisis of 2009 – but also showcased, how quickly markets react and how fast the can recuperate when positive news are on the horizon.

Let’s start by remembering what happened

News of the coronavirus

At the beginning of 2020, you could find news about a coronavirus in China, but for the rest of the world life went on as usual.

Economies around the world looked very strong, trade-deals were done and the year started on an optimistic note.

Sudden change

This all changed, when the coronavirus became a pandemic in March 2020. The virus spread rapidly around the world and so did the panic on financial markets. During the very short period of 3 weeks, many markets declined by more than 30%. This was one of the fastest declines in history.

All our lives were affected, economies were shut down and the world went into a lockdown.

Deep pockets and hope

Government and central banks around the world reacted in an unprecedented way in order to support the economies. Interest rates were lowered and budget spending increased.

Although many sectors of the economy, like restaurant and tourism, took hard hits, many other companies benefited from the ongoing digitalisation trend. Already in summer hopes and talks about a vaccine emerged.

Market recovery

This led to a steady recovery in the markets, and even the uncertainties regarding the election of a new president in the United States could not stop the ongoing recovery.

At the end of 2020, many markets were at the same or even higher levels than at the beginning of the year. A trend that has been continuing even in 2021.

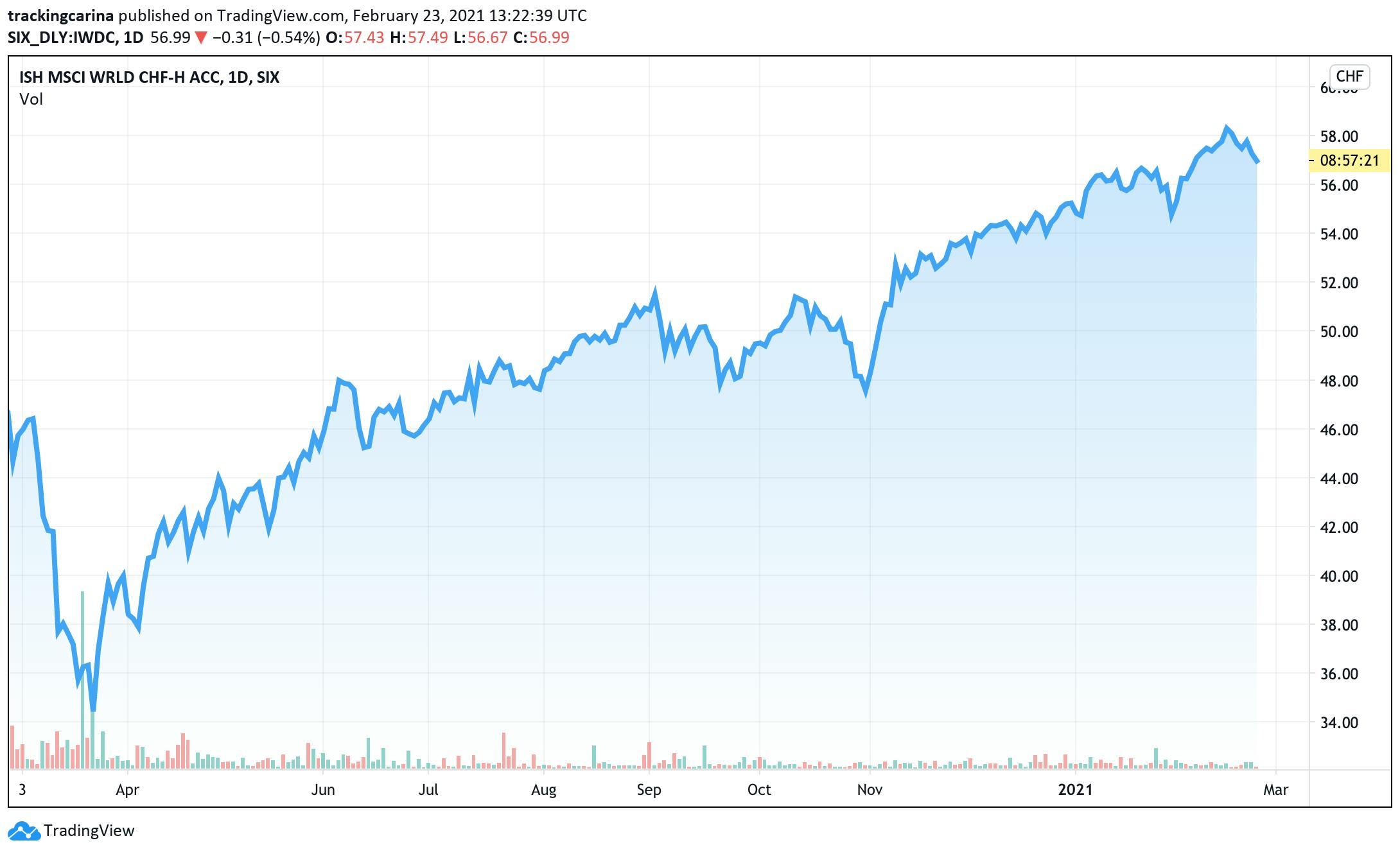

A glance at how the world market has developed within the last year

What did Selma do in 2020?

👩💻 …in customer support

Throughout the time of the crisis, the Selma crew continued to communicate to you, our clients and potential investors, that you should only invest money that can remain invested long-term (at least 5-10 years) and invest regularly.

These tactics help you to keep a cool head and avoid emotional decisions – and many of you stayed cool during the year, grinding your teeth but focusing on your investment plan! And yes, it paid off! High five to everyone 🙌

📊…in investment management

Selma continuously monitors the markets and checks if updates to your investments make sense based on changing valuations.

Already at the beginning of 2020, Selma measured that many markets were quite expensive. This does not mean that Selma automatically opts to sell everything, but Selma did decide to keep a larger than usual amount in cash. Many clients could see about 10-15% of “cash” as part of their plan.

End of February, Selma implemented a new feature to improve the cash situation in overvalued market times. Selma added precious metals (gold and silver) to her plan.

Then came the coronavirus crisis and markets declined more than 30%.

Now Selma – your friendly, but not too easily spooked bot – found that markets actually looked more attractive again and sent a signal that investments should be switched out of precious metals and more into growth.

This switch towards buying “growth investments” when markets were cheaper happened end of March. Since then markets have recovered steadily.

The gist

Long-term investing without second-guessing pays off

What can I take away for 2021?

2020 can offer us a lot of learnings for the future on how to invest long-term

- Only invest money that can remain invested for at least 5-10 years. You don’t want to come into the situation where you have to withdraw money when a crisis hits. As we say in 2020, the markets recovered within the same year! So even holding out a few months, allowed you to make it through the crisis without harm. 👍

- Do not invest everything at once, stepwise investing is a tactic which allows you to build up your investments over time and frees you of “waiting for the right time”.

- Keep investing regularly! Dollar-cost-averaging gets you a better average price and making a plan usually helps keeping your head cool. ❄️

- Do not panic! 😱 Everybody felt shaken last year, not just you! But your investments also recovered within the year – if you would have sold everything when markets crashed in March, you would have lost a lot of money.

- Keep your profile at Selma updated. This helps Selma to make sure your investments are right for you.

- Invest in many different things at once. This limits the influence of one company or sector to the overall development of your investments – a great way to handle risk of ups and downs of specific industries and markets much better.

As always, remember: the “Selma” rules for investing

- Only invest money that you can leave invested long-term.

- Keep a big enough cash buffer on your bank account to protect you from unplanned expenses. Factor in possible unplanned expenses as well! 👩💻

- Invest regularly to get a steadier average price. This way, over time, you will buy more when it’s cheap and less when it’s expensive.

- Invest in many different things at once instead of betting on a few shares or products to do well.

- Be aware of risks. Markets will always move up and down, therefore your investments will also always move in value. You shouldn’t only focus on how much risk you want to take, but also how much you can take.

- Keep your profile updated to make sure Selma manages your money based on your current financial life. 📊

- Do not try to time the market and wait for the perfect moment – nobody has the crystal ball and can see in the future

Investing the Selma way in 2020

Investing long-term, regularly and in a broad mix of investments, is a great way to build your wealth over time – despite the ups and downs that happened in 2020.

How did Selma as a company do during the crisis?

Selma was founded as a remote-first company. Therefore, the switch to home office was no problem in the Selma crew’s work life. You can follow us on Instagram to get some behind-the-scenes footage of our work.

Selma has seen strong growth in customers and investments. Many new clients decided to start investing when prices were low, existing customers who believe in Selma’s philosophy during crises started investing more. 📈

The Selma crew grew in 2020, and continues to hire in 2021.

Last but not least, Selma’s performance during this difficult time has been rewarded by a successful Series-A-investment round into the company itself by TX Group & Sparrow Ventures, the venture builder and growth equity investor of Migros Group. Learn more about Selma’s investment round.

Carina Wetzlhütter

Carina makes technology understandable. She joined Selma to help explain finance in a more human way. Winter being her favorite season, she loves ❄️ and 🎿.

LinkedIn