Alternative investments: how art & collectibles can be part of a well-diversified portfolio

Diversification is the key to a resilient investment portfolio. But how could you further diversify it? We reached out to Dr. Aurelio Perucca, co-founder & CEO at Splint Invest, Swiss platform for investing in art, luxury goods and collectibles, and asked why he thinks such alternative assets can provide investors with a new avenue for diversification.

Dr. Perucca, how would you describe alternative investments?

Alternative investments, or alternative assets, encompass a diverse range of assets that go beyond traditional investments like stocks, bonds, and cash. This category includes physical assets such as precious metals and gemstones, collectibles (like art, fine wines, rare whiskies, classic cars, and antiques), and luxury goods (such as high-end watches or designer items). Additionally, certain financial assets—private equity, commodities, and peer-to-peer lending, for example—are also considered alternative investments.

High-net-worth individuals have long incorporated alternative investments into their portfolios, often dedicating a significant portion to these types of assets. A Lombard Odier survey reveals that a third of wealthy participants allocate over 10% of their portfolios to alternative assets. Recently, however, retail investors are increasingly interested in diversifying their portfolios with alternative assets.

Why haven't retail investors embraced alternative assets sooner?

Historically, retail investors have faced several challenges in accessing alternative assets:

- High entry thresholds: For example, most individuals cannot afford a Patek Philippe Grand Complications watch for 68,000 francs or Salvador Dali’s Hidden Faces at around 480,000 francs.

- Specialized knowledge and maintenance requirements: Determining authenticity and handling the upkeep of assets like a Macallan whisky cask or a Ferrari 348 TB has traditionally necessitated assistance from private banks or specialized providers.

- Limited access: Sometimes, investors find that even when they have the capital, there may be long waiting lists or limited public availability for items like luxury watches.

Today, fractional investments, regulated in Switzerland and the EU, help retail investors clear the biggest hurdle. Now, one can invest as little as 50 francs in a 500-franc artwork, co-owning the asset legally and sharing in its value growth proportionately.

The remaining barriers are being addressed by financial organizations that handle the necessary expertise and manage assets for fractional investors.

What advantages do alternative investments offer?

Alternative assets can serve multiple purposes, depending on one’s portfolio composition and strategy:

- Inflation protection: Assets like high-grade diamonds and platinum bullion have displayed monthly volatility below three percent. With a global equity market correlation under 0.26 (source: Bloomberg), these assets can act as a hedge.

- Potential wealth growth: The Knight Frank Luxury Investment Index notes that returns in certain alternative asset classes—such as fine art, rare whisky, and luxury watches—averaged over 10% annually over the past decade, often surpassing both the DAX 40 and the S&P 500.

- Values-based investing: Alternative assets can also offer opportunities for passion-driven investments, from eco-friendly ventures to collectible hobbies like vintage cars or LEGO sets.

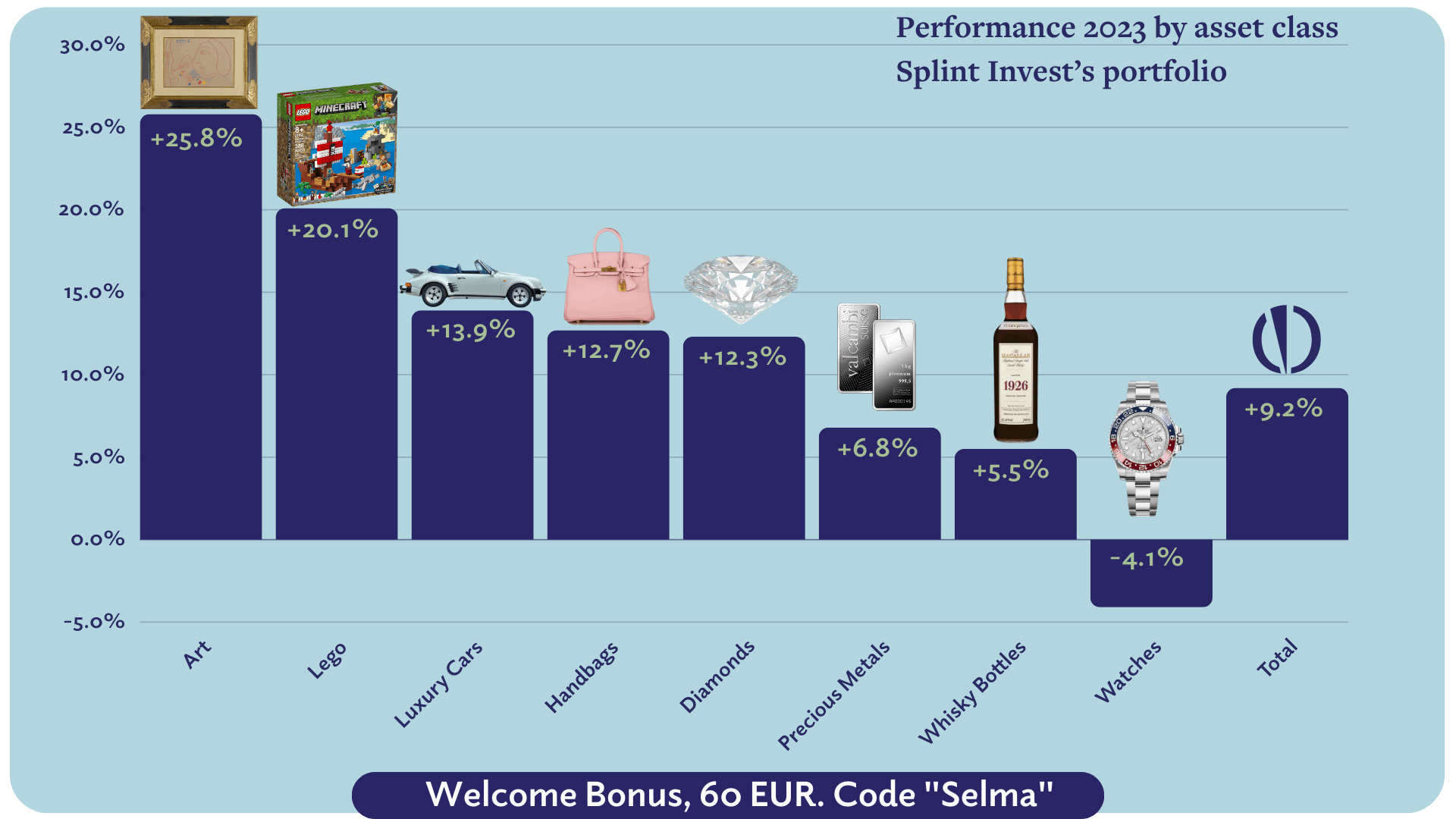

How do alternative investments compare in performance to traditional assets?

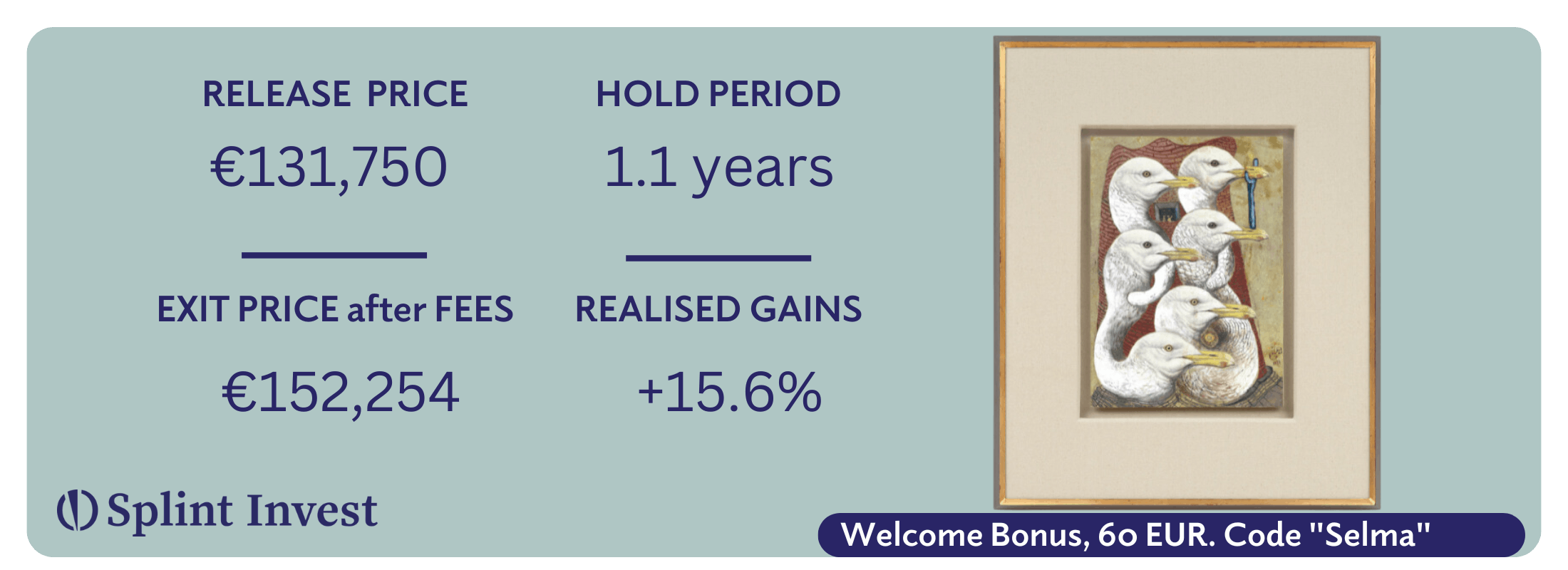

Performance varies significantly across alternative assets. Some have low volatility and yield around 2-3% per year, while others, like works from emerging artists, may yield returns exceeding 20% depending on risk tolerance and strategy.

For example, Splint Invest assets outperformed several benchmarks in August 2024, with some outpacing the S&P 500 (+3.9%) and the DAX (+2.2%). Over the same period, an artwork by Raghav Babbar, an emerging artist, rose by six percent.

What advice would you give to investors new to alternative assets?

To those exploring alternative investments, the primary advice is to diversify across different asset classes. For those unwilling to spend extensive time researching, working with a reliable intermediary is a wise choice.

Splint Invest*, Switzerland’s largest platform in this field, simplifies access to alternative assets for private investors. Registered with VQF (Nr. 100956), Splint Invest operates in Switzerland, the UK, and the EU, with investments starting from just 50 euros. The app enables users to fund their accounts and invest in fractional ownership (Splints).

*Splint Invest is a brand. The regulated company that operates the Splint Invest platform is MARK Investment Holding AG.

With over 30,000 registered users and 21 million euros under management, Splint Invest currently offers access to more than 10 asset classes. The app can be downloaded, and an account created, allowing investors to begin in under two minutes. You can download the Splint Invest app, create an account, and begin investing in alternative assets – all in less than 2 minutes.

We are glad to offer new users a 60 euro welcome bonus with the code Selma * – so they can test the whole process without investing their own money. Click the link to download the app. You can also find Splint Invest app on App Store and on Google Play, or use the web portal on www.splintinvest.com.

*The offer is valid for new users only.

Niklas Linser

Niklas is taking care of Selma's digital marketing channels. He is an expert in communication, holds a degree in international economics and is way too passionate about. 🎾

LinkedIn