A strong start into 2025: Diversification is paying off

Ever wondered if your investment strategy is really working? If your portfolio is diversified, the answer is yes. 2025 has kicked off with strong market momentum, and investors with a well-diversified portfolio are seeing the benefits.

Some markets are booming, others are stabilising—but that’s exactly the point. When your investments are spread across different asset classes and regions, you’re in a better position to capture growth and manage risk.

Global markets move in different directions — and that's a good thing

US & European stocks: A shift in leadership

After a strong 2024 for U.S. tech stocks, European markets are now taking the lead. Germany’s DAX is up around 14%, with Swiss, French, and Spanish indices also seeing double-digit growth. Why? European stocks were relatively cheap compared to U.S. stocks, and expectations of interest rate cuts have boosted investor confidence.

Emerging markets: Catching up

Emerging markets are picking up speed too. Hong Kong’s Hang Seng index is climbing again, fueled by tech innovations—like breakthroughs from China’s DeepSeek.

Gold: The classic safe haven

Investing in gold and silver is part of the Selma investment strategy. Uncertainty around potential new tariffs in the U.S. has pushed investors toward gold, driving prices to a record high of over $2,900 per ounce.

Bonds: A return to stability?

With interest rate cuts expected, bonds are becoming more attractive again. Lower interest rates tend to push bond prices higher – good news for anyone with bonds in their portfolio. Selma decides whether bonds ("loans to companies or countries") should be part of your investment portfolio based on your investor profile.

Why diversification works

This mix of market movements reinforces a fundamental investing truth: diversification works.

No one can predict which markets or asset classes will outperform in any given year. But by spreading your investments across global stocks, bonds, and commodities, you balance the ups and downs and increase your chances of solid long-term growth.

That’s exactly what Selma’s investment strategy is designed to do—keep your portfolio diversified so you can benefit from market fluctuations while managing risk.

Reach your financial goals faster – here is what you can do now

Your portfolio is working for you. Now, make sure you're making the most of it:

✅ Invest regularly – Market fluctuations work in your favour when you invest consistently. If you haven’t set up a standing order yet, now might be the time.

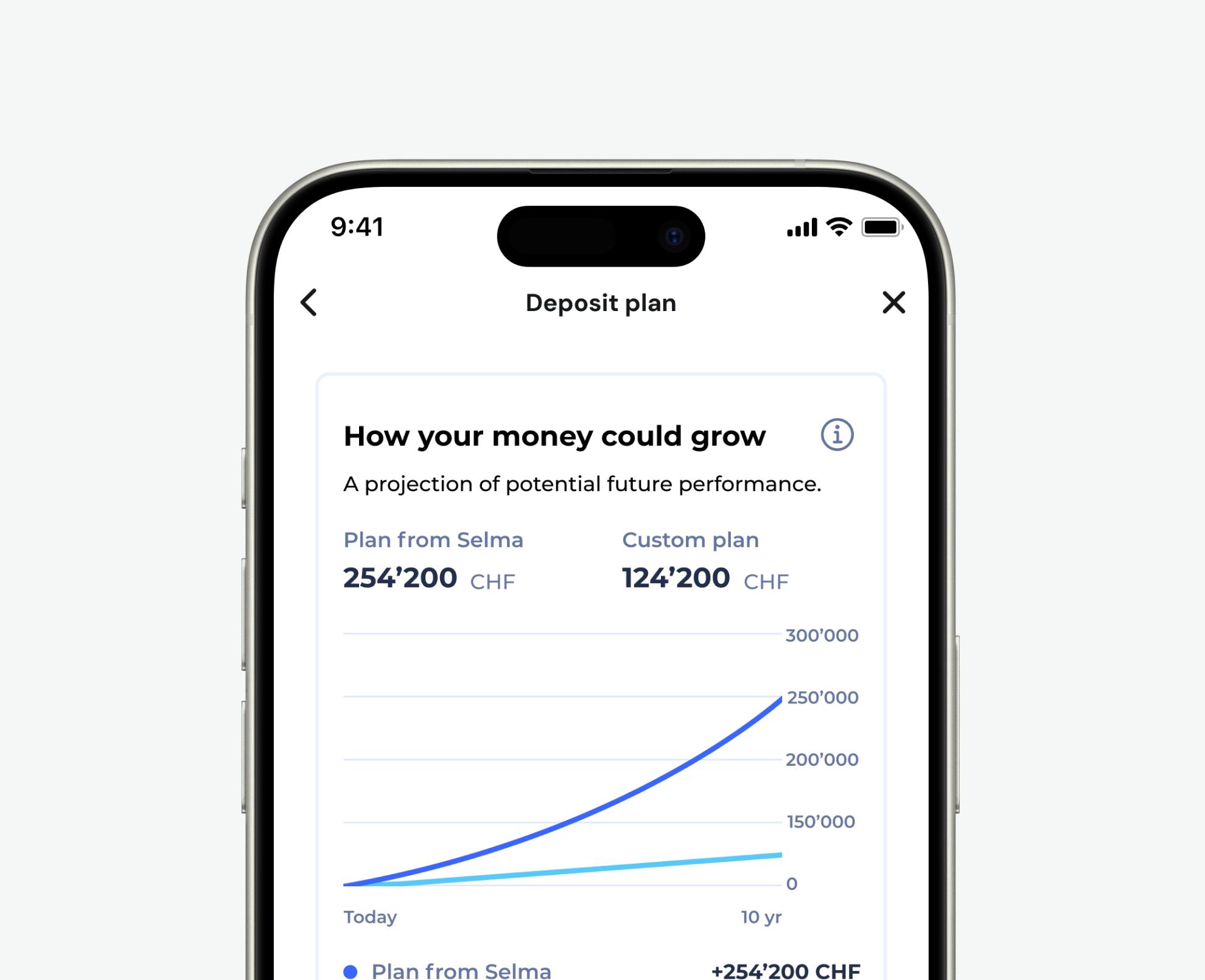

✅ Review your investment potential – Are you making the most out of your financial potential? Adjusting your recurring deposits could help you stay on track with your long-term financial goals.

📌 Take action now: Check your investment potential with the help of the Selma Deposit plan in the Selma app and make sure you're making the most out of your investment potential going forward.

👉 Reach your investment potential!

Carina Wetzlhütter

Carina makes technology understandable. She joined Selma to help explain finance in a more human way. Winter being her favorite season, she loves ❄️ and 🎿.

LinkedIn