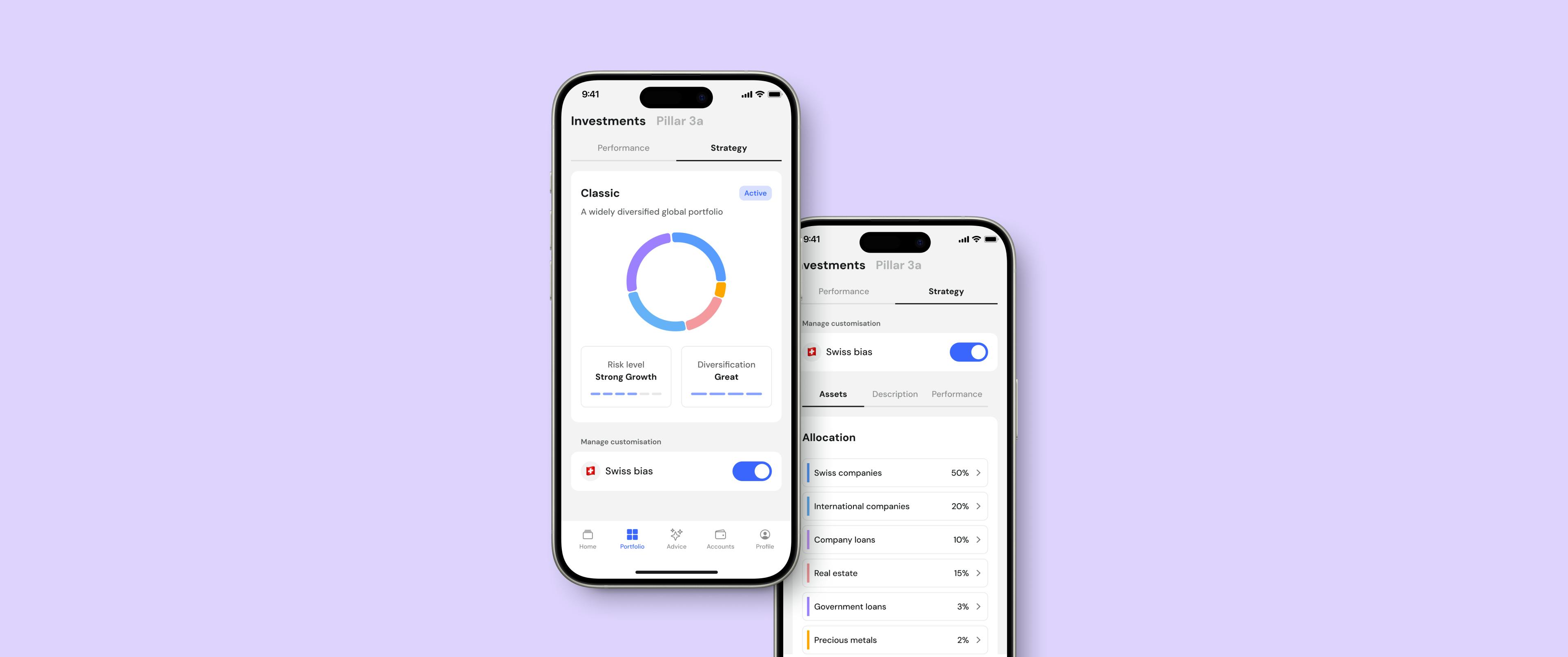

Introducing Swiss bias: Customise your Selma portfolio with more Swiss investments

Selma now lets you customise your portfolio to focus more on Swiss companies and real estate by allocating more of your investments to Swiss assets. The Swiss bias aims to invest a target of 50% in Swiss companies and switches all your real estate investments into Swiss real estate.

You wanted more ways to customise Selma's portfolios to match your personal preferences and values. Activating the Swiss bias is the next step in adjusting your portfolio further. This means there are now two options to combine your preferences with Selma’s diversified investment strategy:

- 🌱 Sustainability and

- 🇨🇭 Swiss bias (a Swiss "home bias")

The Swiss bias is particularly interesting if you want to adjust your portfolio's international exposure, invest more in local companies, or minimise currency risks to prepare for retirement.

You can activate the Swiss bias in the Selma app for iOS and Android. It is available for portfolios starting from CHF 7'500.

What is the Swiss bias?

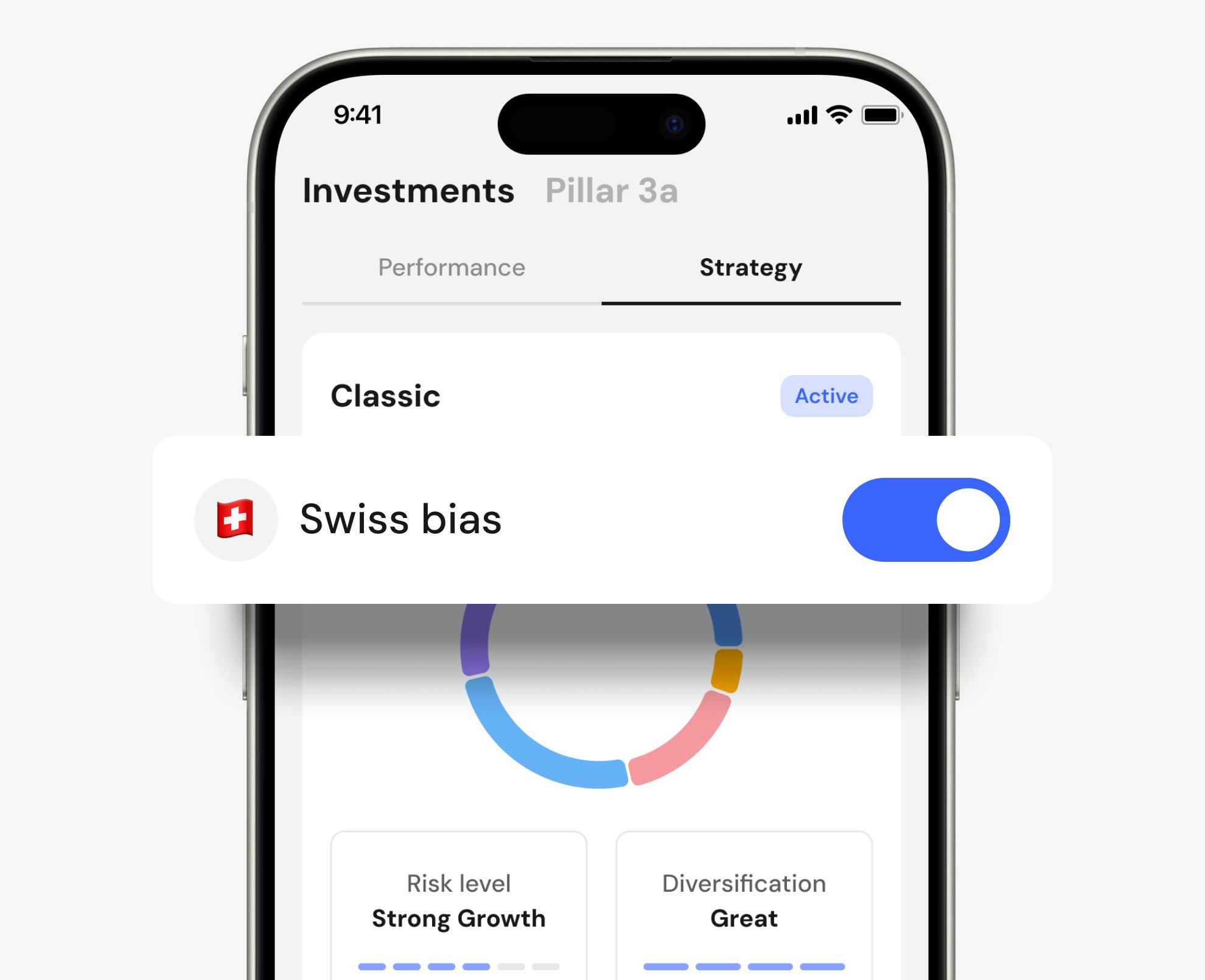

This feature lets you adjust your investment preference to focus more on Swiss investments. By toggling this option, Selma will allocate a higher proportion of your portfolio to Swiss ETFs, creating a “home bias”. 🇨🇭

What is a home bias?

A home bias is the tendency to invest a larger portion of your portfolio in domestic markets. This approach often reflects a preference for familiarity, confidence in local market performance, or a desire to reduce currency risk for investors planning to use their funds domestically.

Keep in mind: A home bias lowers the level of diversification as it adds more weight to a specific market.

Why Swiss bias at Selma?

Over the years, many of our clients have asked for a way to focus more on Swiss investments. Whether it’s a sense of familiarity, supporting local companies, or aligning with pension strategies, the reasons are as diverse as our clients.

By introducing Swiss bias, you can align your portfolio with your preferences while maintaining the diversification Selma is known for. 🇨🇭

Is this portfolio for me?

This portfolio option is ideal for investors seeking long-term growth with a focus on the Swiss market. Here's why it might be the right choice for you:

- You believe in the strength of the Swiss market: You expect Swiss ETFs to perform better than international markets.

- You trust in a strong Swiss Franc: You think the Swiss Franc will gain strength compared to other currencies.

- You're planning for retirement in Swiss Francs: A portfolio with more domestic assets helps minimise currency risk when you eventually withdraw funds for Swiss-based expenses.

You can always reach out to our team of financial experts if you're not sure about customising your portfolio by yourself.

My Selma portfolio is already custom-made – why should I customise it further?

At Selma, we believe your portfolio should reflect your financial situation and be aligned with your values and goals.

Your Selma portfolio is already fully personalised to fit your risk situation and financial objectives and features like Swiss bias and sustainable investments allow you to go a step further, adding your personal preferences and values on top of your tailored investment strategy.

Customising your portfolio with the Swiss bias gives you the freedom to focus on local investments while still enjoying the benefits of global diversification. Paired with options like sustainable investments, you now have even more ways to personalise your portfolio and make it truly yours.

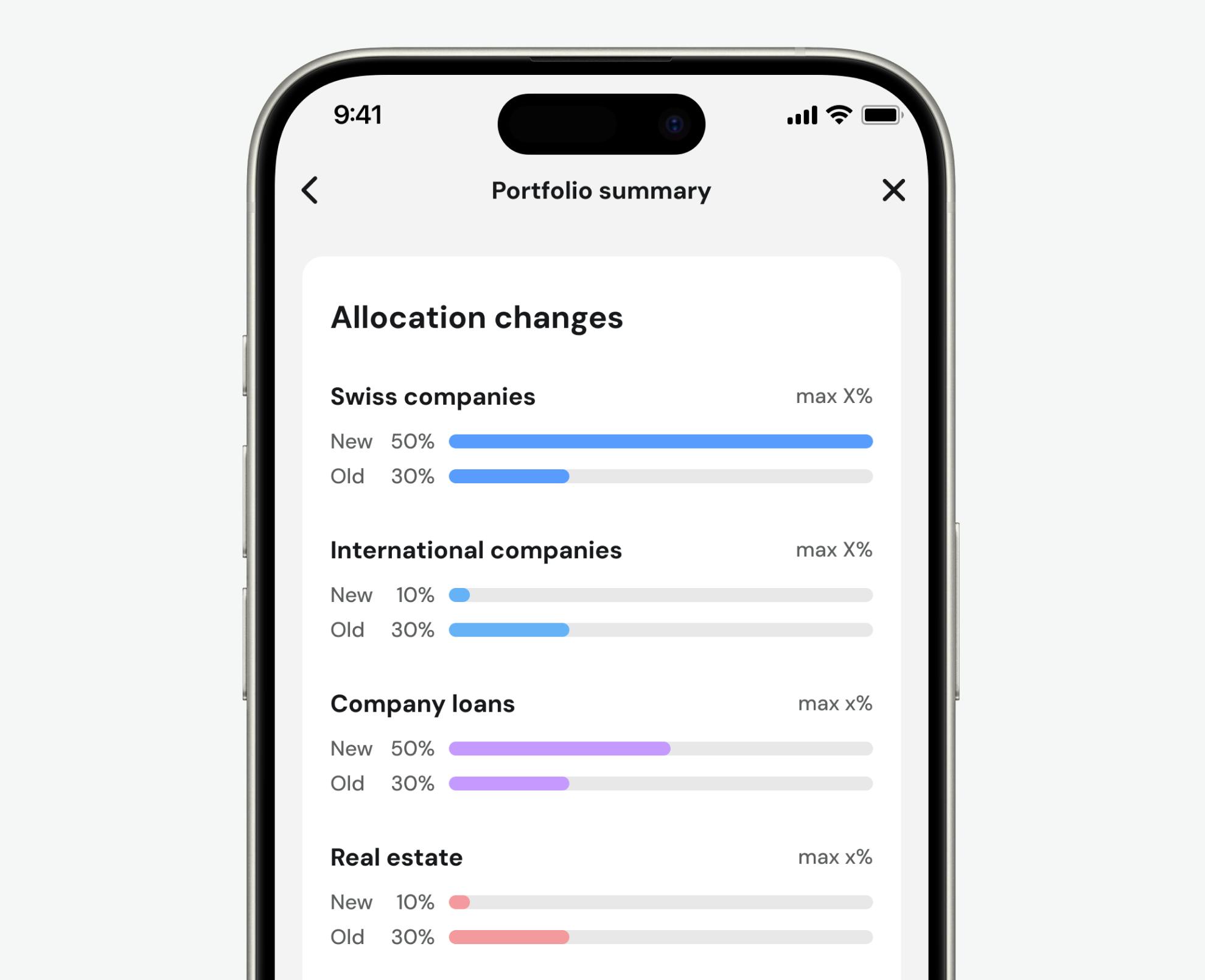

Keep in mind that a "home bias" will still decrease the diversification of your portfolio. When editing your strategy, Selma will show you new allocations and inform you about the diversification and risk levels.

How does it work?

- Available in the mobile app: Access the feature directly from your Selma app. Adjusting your sustainable preference will be added in the near future. For now, you can enable your sustainability preference via the web app.

- Starting at 7'500 CHF: This feature is designed for portfolios starting from 7'500 CHF to ensure your investments are still well-diversified. This minimum allows for the ability to invest in ETFs without unnecessary trading costs or imbalances, maintains sufficient diversification, and upholds Selma's investment strategy for long-term growth.

- Costs and details: For full transparency, you can check out our FAQ for more information about fees and how the feature works.

Ready to add a Swiss touch to your investments?

Customising your portfolio has never been easier. Open your Selma account today, download the mobile app, and explore the new Swiss bias feature! Your personalised portfolio, your way.

👉 Open your Selma account

Carina Wetzlhütter

Carina makes technology understandable. She joined Selma to help explain finance in a more human way. Winter being her favorite season, she loves ❄️ and 🎿.

LinkedIn